Hi all. In this post, we will see TCS Management in Saral Accounts and Billing software.

Tax Collected at Sources also known as TCS is the tax collected by the seller from the buyer at the time of sale of goods.

To know more on TCS, read below:

https://www.saraltds.com/blogs/tax-collected-at-source-introduction/

To know more on the rate of tax applicable on the sale of the above goods, read below:

https://www.saraltds.com/blogs/tcs-rate-chart/

In Finance Bill 2020, recent changes have been brought on TCS applicability which can be read below:

https://www.saralaccounts.com/blogs/change-in-tcs-provision-2020/

TCS Management in Saral Accounts

In Saral Accounts, the complete process of TCS computation is automated.

Benefits of TCS Management in Saral Accounts

- Complete process automation.

- Errors due to manual calculation and processing is reduced

- The effective date for any new changes will be auto considered

- Flexible to apply TCS for items and party ledgers

- All types of views and reports are available for TCS computation

TCS Management in Saral Billing and Accounts is as explained below

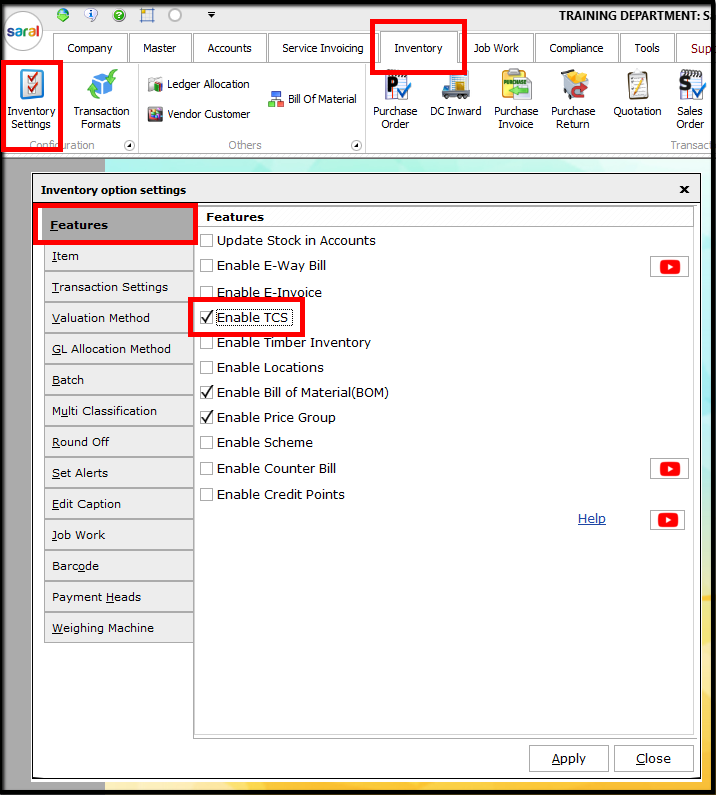

First, let us see the basic configuration required. To enable the TCS process, go to Inventory Settings under Inventory and click on Enable TCS in Features. After enabling the option, save, and exit.

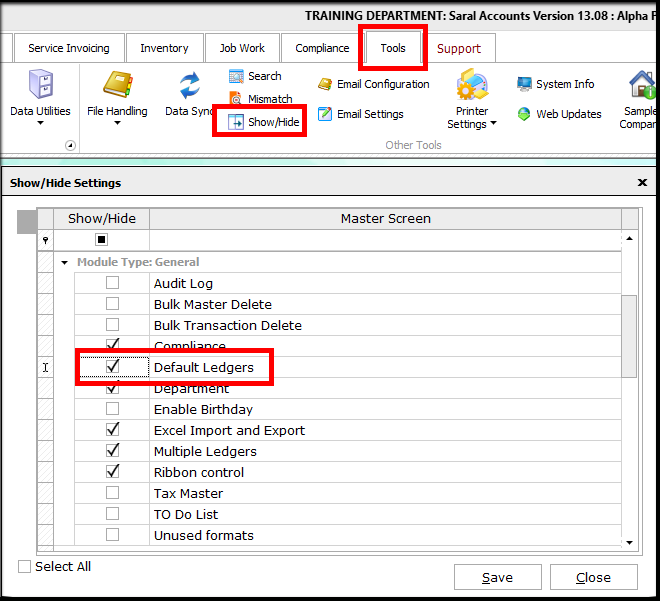

Next, create the required ledgers. Go to Show/Hide under Tools and select Default Ledger. Save the selection.

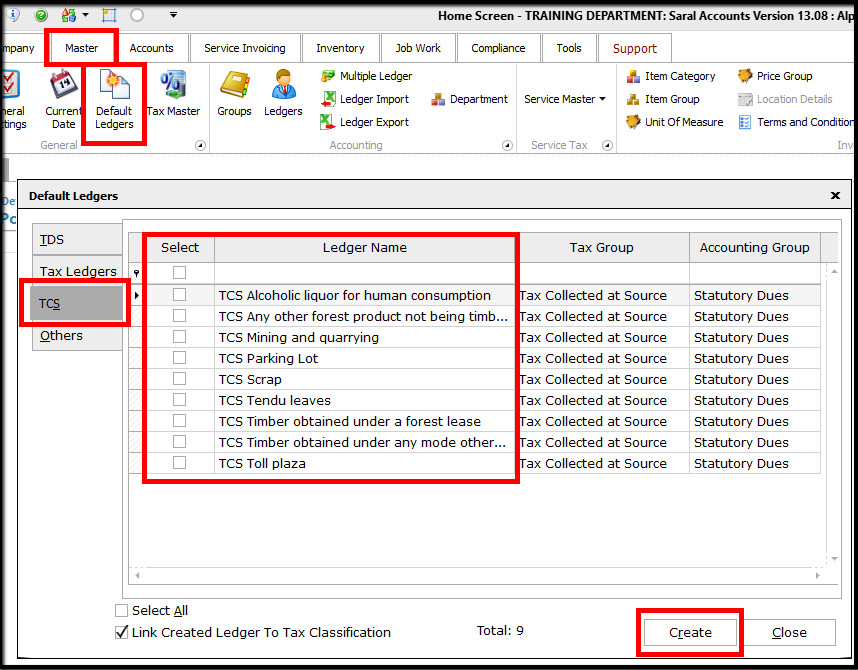

Now, go to Default Ledger under Master and select on TCS. Here, select the required section statutory ledgers or click on Select All. Click on Create and the required ledgers will be created.

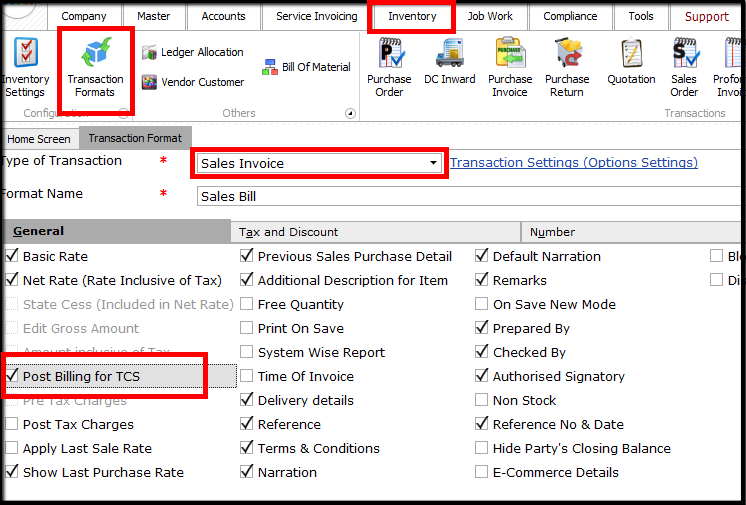

To enable TCS in Invoice, go to Transaction Formats under Inventory and select the required format. Enable Post Billing for TCS and save the format setting.

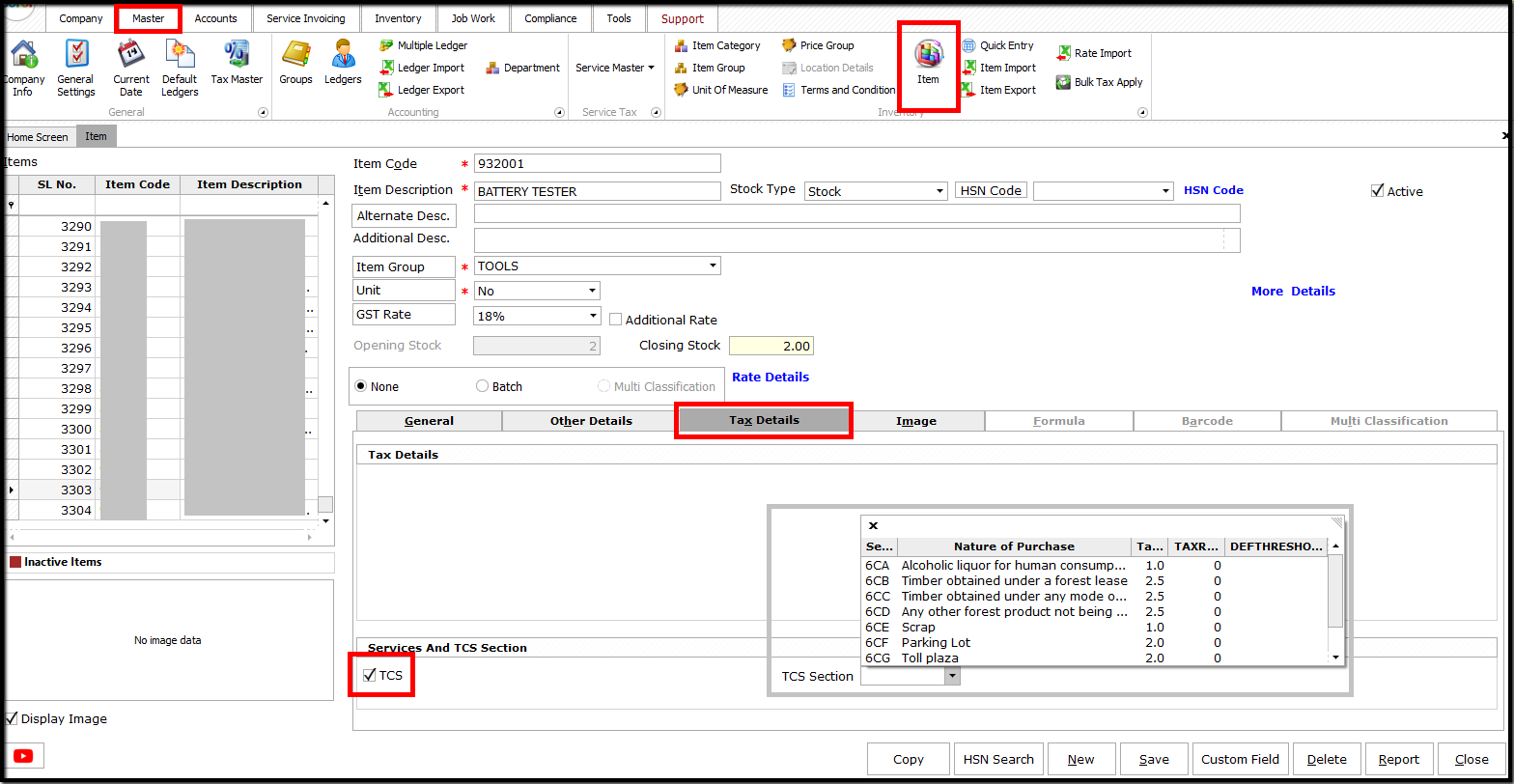

To make TCS applicable for an Item, go to Item under Master and select/create an item. Click on the Tax Details tab and enable TCS. Select the applicable section from the list and save.

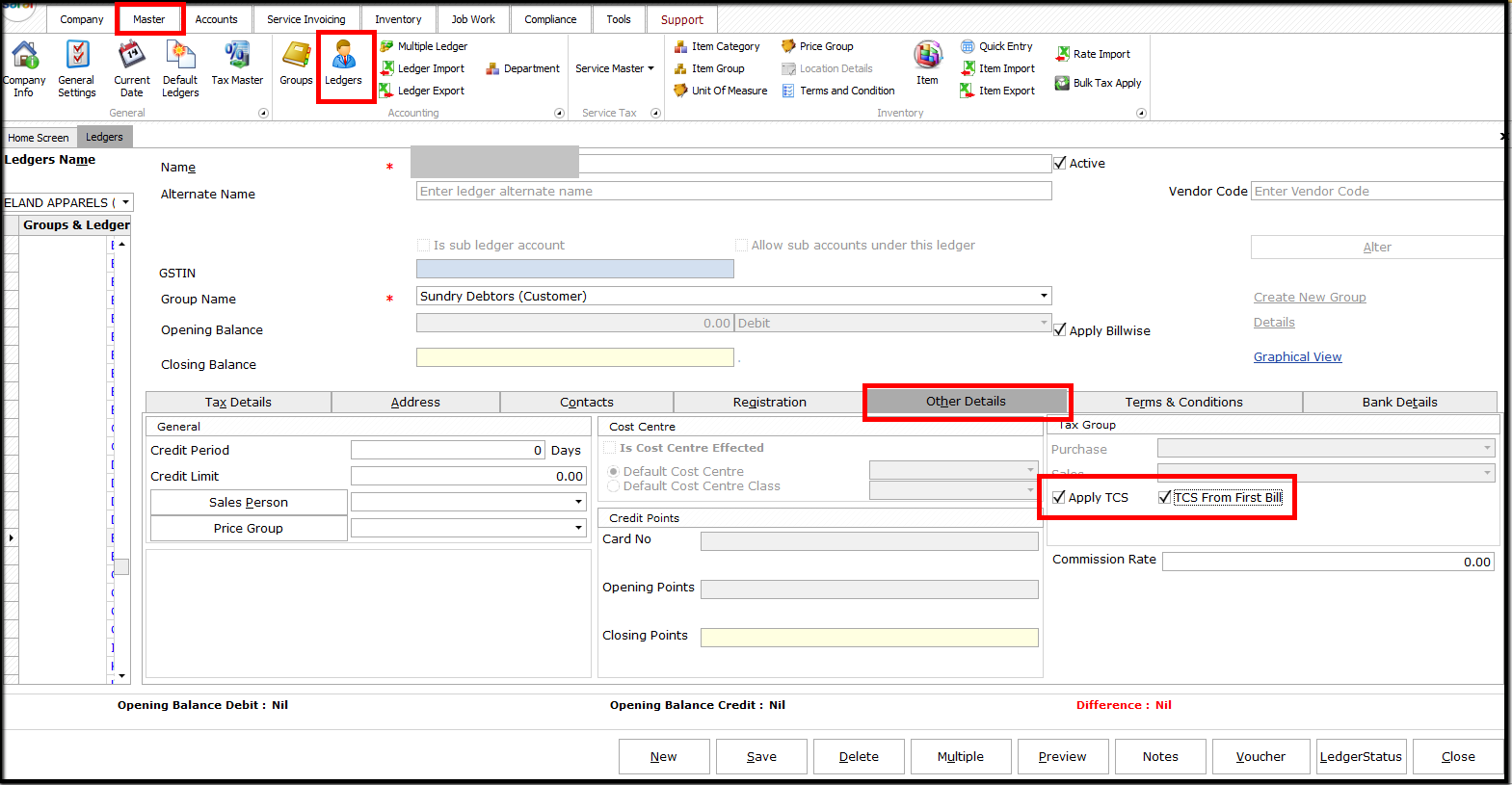

Lastly, to enable TCS for a Party/Customer, go to Ledger under Master and select/create a party/customer ledger. Click on Other Details tab and enable Apply TCS. Then, enable TCS From First Bill if the TCS has to be collected from Re. 1 of Invoice.

The recent changes in settings and implementation of the TCS in the invoice will be explained in the next post.