In this post, we will see a short introduction and types of vouchers in accounting.

We will cover the following topics:

What is a voucher in accounting?

Voucher is a document that act as evidence for every business transaction. When you enter a transaction, you should also submit the evidence to confirm it. Therefore, maintaining voucher helps to record each expenses/liability with high accuracy.

Vouchers are also known as source documents, because it can identify the transaction source. A few examples of vouchers are bill receipts, cash memos, pay-in-slips, cheque, invoice, a debit / credit note.

Supporting document

Accountants thus prepare these vouchers based on a list of supporting documents, and they are :

- Supplier’s Invoice

- Vendor/supplier name to be paid

- Details like amount to be paid, the due date, and discounts given by supplier to pay the invoice early

- Company’s purchase order

- Receipt of the goods company had received from the supplier

- The general ledger accounts to be used for accounting purposes

- Signatures from company’s authorized representatives for all purchase and payment

- Payment proof and date when supplier’s invoice had paid

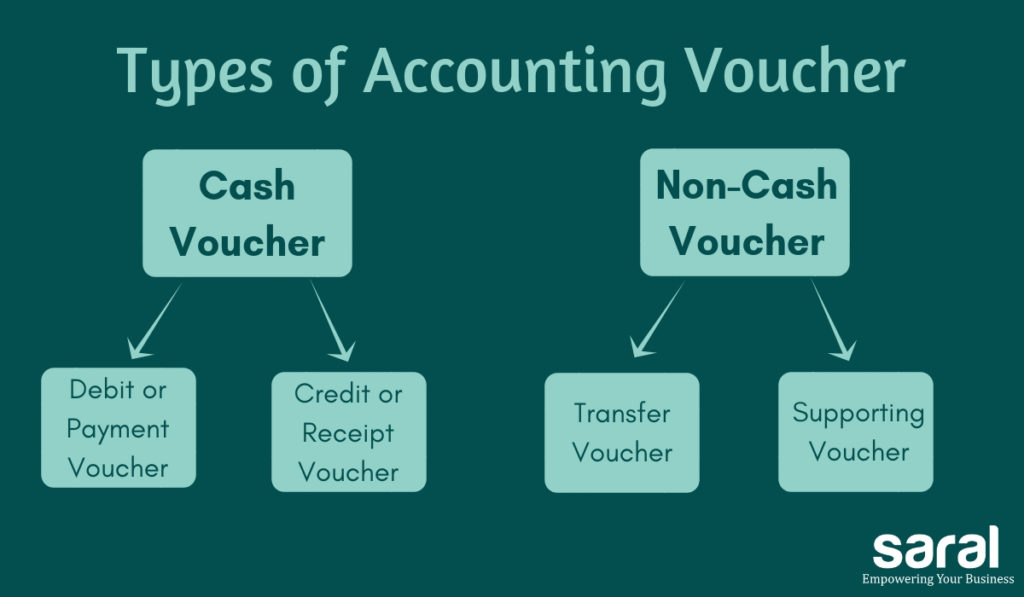

You can divide the vouchers into 2, and they are:

- Cash vouchers

- Non-cash vouchers

I. Examples for Cash voucher

- Credit vouchers

- Debit vouchers

II. Examples for Non-cash vouchers

- Debit note

- Credit note

- Invoices

Benefits of Voucher

Now let us see the list of benefits for using vouchers in a balance sheet.

- To maintain control over the payment process.

- High accuracy of business transactions.

- Makes it easy to identify the transaction source.

- Many invoices can be paid at once (reducing the number of cheque).

- Invoice approval is separated from invoice payment, makes it easier to schedule.

- Serve as a key source of evidence during company audit.

- Reduces the risk of employees who try to steal company assets.

Components of Voucher

A voucher usually contains the following information in them:

- Supplier identification number

- Payable Amount

- Date on which payment will be made

- Accounts payable to record the liability

- Discount for early payment (if applicable)

- Approval signature or stamp

Types of Vouchers in Accounting

There are 4 different types of accounting vouchers, and they are:

- Debit or Payment voucher

- Credit or Receipt voucher

- Non-cash or Transfer Voucher

- Supporting Voucher

Debit or Payment Voucher

In order to record a payment of cash or cheque, you can use this payment voucher. In this case, the cash/bank will be credited and then there will be an outflow of funds.

Credit or Receipt Voucher

A Receipt voucher is used to record cash or bank receipt. Here there is an inflow of funds.

Receipt Vouchers are of 2 types:

- Cash receipt voucher – It represents receipt of cash in hand

- Bank receipt voucher – It indicates receipt of a cheque or demand draft i.e., the assessee did not receive cash in hand. Instead, it got credited to his/her bank account.

Non-cash or Transfer Voucher

For any non-cash transactions, you can make use of this non-cash vouchers. You can consider this voucher as a documentary evidence. e.g., Goods sold on a credit basis. Thus, the cash / bank account of the assessee is not affected.

Supporting Voucher

The supporting voucher serves as documentary evidence of all the past transactions. For example, you can attach the expense bill with the original voucher to support the primary voucher. Petrol Bills attached to the conveyance vouchers is a good example of Supporting Voucher.

Note:

Journal vouchers used to process current accounting entries, allocations, and corrections in the financial system. They are generally used for correcting an incorrectly recorded cheque, expenditure, or cash receipt.

This ends the post on different types of vouchers in accounting.

Related:

You can also learn how it works in Saral