Hello, in this post we will see the three types of electronic ledgers under GST for the taxpayers.

We will discuss the following options:

What is a GST e-ledger?

The electronic ledger/ e-ledger is an e-passbook in the GST portal for each registered taxpayer. So, these ledgers provide information on tax dues, tax liability, and tax deposited, input tax credit earned and used, refunds granted, interest and penalties.

A registered taxpayer generally has 3 different electronic ledgers under GST. These e-ledgers are created during the GST registration process, and they are:

- The Electronic Tax Liability Ledger

- Electronic Cash Ledger

- Electronic Credit Ledger

Now let’s discuss these e-ledgers in detail;

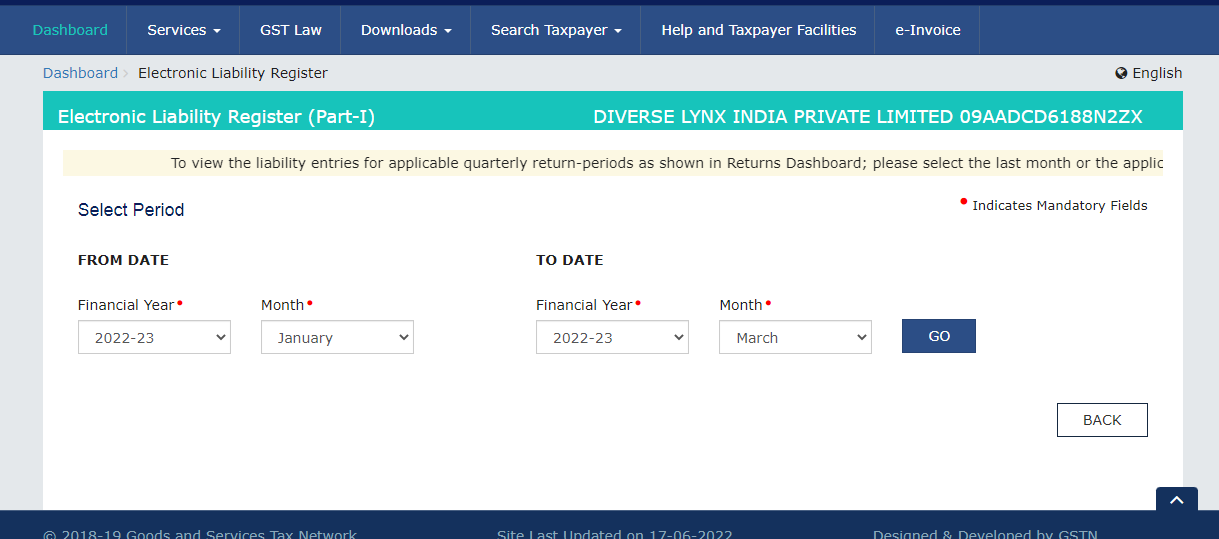

1. The Electronic Tax Liability Ledger

An electronic tax liability registers, maintains and records taxpayer’s all GST liabilities for every month.

The liability ledger is maintained in the Form GST PMT- 01 for each person who is liable to pay tax while filing GST return, interest, penalty, or any other amount on the Common Portal.

The ledger also contains the manner of GST liability payment (cash/credit). Thus, it displays the amount paid to clear the liability by transferring balance credit from the other 2 ledgers.

Different GST payment forms

Different GST payment forms

| No. | GST Payment Form | Details | Use |

|---|---|---|---|

| 1 | GST PMT-01 | Electronic Tax Liability Register | Any tax, interest, penalty, late fee, or any other amount is debited |

| 2 | GST PMT-02 | Electronic Credit Ledger | ITC claims are credited |

| 3 | GST PMT-03 | Refund to be re-credited | Refund of unclaimed ITC, if rejected, the amount debited from the Electronic Credit Ledger, is re-credited by order of a proper officer |

| 4 | GST PMT-04 | Discrepancy in Electronic Credit Ledger | To communicate any discrepancy in Electronic Credit Ledger |

| 5 | GST PMT-05 | Electronic Cash Ledger | Any tax, interest, penalty, late fee, or any other amount deposited in cash are credited here |

| 6 | GST PMT-06 | Challan for deposit of tax, interest, penalty etc. | To generate and pay a challan |

| 7 | GST PMT-07 | Application for any complaint related to payment | Taxpayer’s application when the amount intended to be paid is debited from his account but CIN (Challan Identification Number) is not generated or generated but not reported to the GST Portal within 24 hrs of debit |

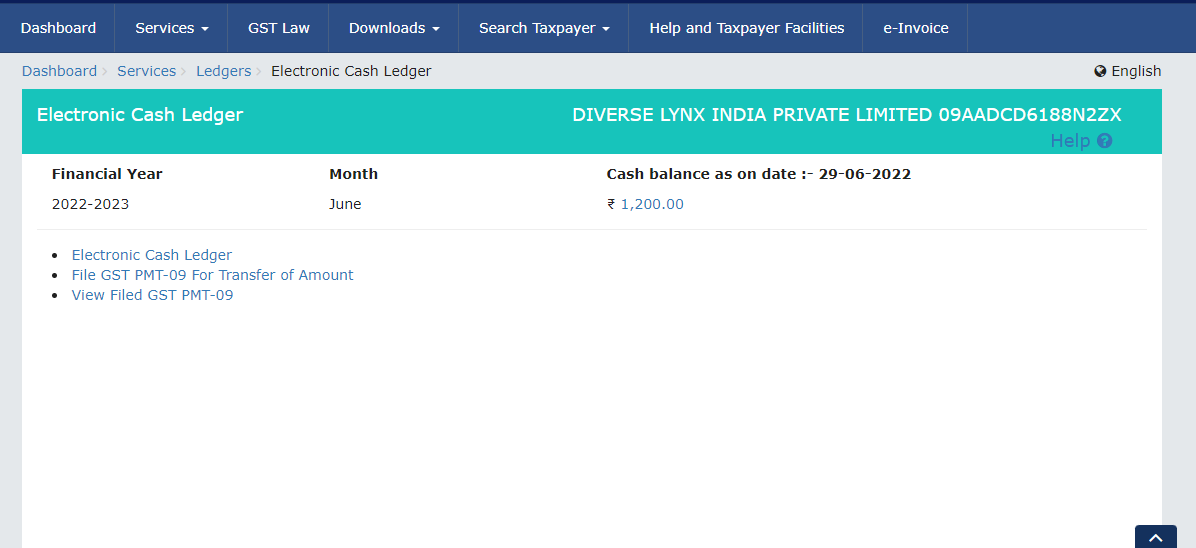

2. Electronic Cash Ledger

The Electronic cash ledger shows the taxpayer a summary of all the record of GST payment done. It is applicable when a taxpayer makes GST payment through online banking, credit or debit card, wire transfer, or over the counter payment.

It is maintained in the GST portal in Form GST PMT-5. However, this cash ledger is accessible for the taxpayer, authorized signatories, GST practitioners, and the Jurisdictional Officials.

It also includes credit for the amount deducted as Tax Deducted at Source (TDS) / Tax Collected at Source (TCS) under GST. The taxpayer can use this amount to pay any liability under the respective major and minor heads. (4 Major Heads: IGST, CGST, SGST/UTGST, and CESS and 5 Minor Heads: Tax, Interest, Penalty, Fee and Others).

For instance, your GST payment is over Rs.10,000, so you can only pay it through a bank. You must specify the heads under which you made the GST payments. Finally, based on the tax challan and heads, it will display your available balance.

Note: Nevertheless, you can not use the amount under one major head to settle the liability under another other major head.

Note: Nevertheless, you can not use the amount under one major head to settle the liability under another other major head.

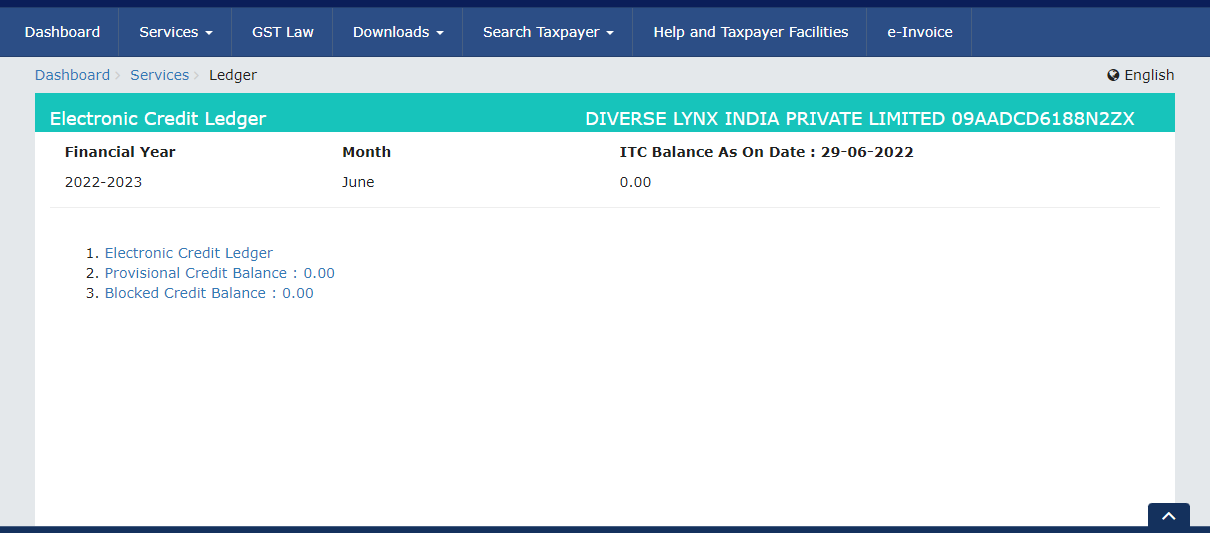

3. Electronic Credit Ledger

An electronic credit ledger under GST records all the tax payments made by a taxpayer. All eligible Input Tax Credit (ITC) that is claimed by a registered dealer in the GST returns (GSTR-2 or GSTR-3B) reflects in Electronic Cash Ledger.

Then it auto fetches registered taxpayer’s data based on the GSTR-1 and GSTR-2 returns filed under GST. So, to compensate GST liability, you can use the credit in your electronic credit ledger.

Note:

Note:

- You can only use the credits only to pay tax, therefore, it cannot be used for paying interest, penalty or late fees.

- Interest and penalty can be paid only through actual cash payment.

The types of credits available are of 3 kinds:

- IGST Credit

- CGST Credit

- SGST Credit

IGST Credit

The taxpayer can use their IGST input tax credit to make their IGST payment. They can also use this credit to pay tax liability under CGST and SGST.

CGST Credit

The taxpayer can make use of their CGST input tax credit to settle their IGST liability, but they cannot pay the SGST liability.

SGST Credit

Taxpayer can utilize their SGST input tax credit to pay the tax liability under IGST, but they cannot settle their CGST liability with this credit.

Note:

- You can utilize the credits in your e-credit ledger/ e-cash ledger to make all GST payments.

- GST portal will generate a unique identification number for:

- Your every debit/credit to the electronic cash/credit ledger.

- If discharge of any liability happen in the e-liability ledger.

- Each credit in the e-liability ledger.

For more information – Electronic Cash Ledger.

We have come to an end of this post. Let us know about your views and queries in the comment section below.