Hello everyone, in this post we will discuss on the GST Service Invoice with the help of templates.

The topics we cover in this post are:

- What is GST service invoice?

- What are the Mandatory components of GST service invoice?

- How many copies of Invoices should be issued?

- Sample template of GST service invoice

What is GST service invoice?

A registered person before or after supplying taxable services within a specific period should issue a tax invoice.

An invoice or a bill of supply shows a full account of all goods sent or services provided by an entity and also the amount to be paid by the client. It should include description, value, tax charged and other details as per the Invoice Rules.

For supply of goods, an invoice is issued before or at the time of supply. But for supply of services, the invoice is issued before or after the supply.

The service invoice should be issued within a period of 30 days from the date of supply of service. When the complete supply of service interrupted because termination of existing contract, invoice issued is based on the supply of service made before the interruption.

Mandatory components of the GST service invoice

A tax invoice is generally produced to charge the tax and handle the input tax credit. As a result, a GST service Invoice should have the following;

- Invoice number and date

- Customer’s name

- Shipping and billing address

- Registered customer and taxpayer’s GSTIN

- Place of supply

- HSN code/ SAC code

- Item details (description of the product, quantity (number), unit (meter, kg etc.), total value).

- Taxable value and discounts in the transaction

- Rate and amount of taxes (CGST/ SGST/ IGST)

- Whether GST is payable on a reverse charge basis

- Signature of the supplier

However when the customer is not registered and the value is more than Rs. 50,000 then the invoice should have:

- Name and address of the recipient.

- The address of delivery.

- Name of state and state code.

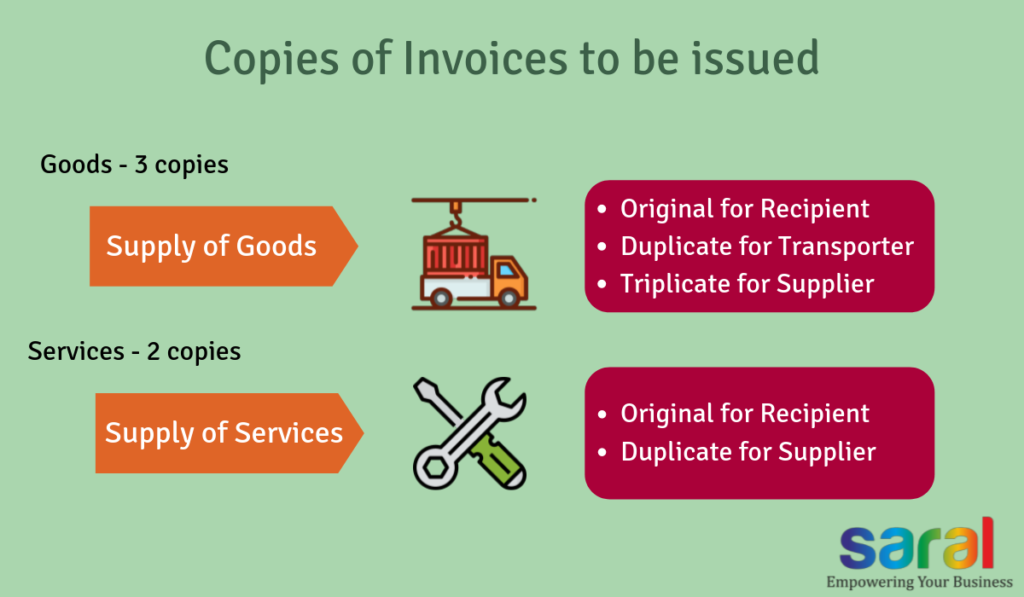

How many copies of Invoices should be issued?

The 3 different tax invoice copies issued based on the receiver are:

- Original Copy: Firstly, it is the invoice issued for the buyer titled as ‘Original for the recipient’.

- Duplicate Copy: Then a duplicate copy is issued for the transporter titled as ‘Duplicate for transporter’. So the invoice for the transporter is not necessary in case the supplier has an invoice reference number.

- Triplicate Copy: This invoice is then issued only for the record of the supplier.

Finally, when the invoice copies are issued, it is solely based on if one is providing goods or services. So 3 copies of the tax invoice are issued for the goods and 2 copies for the services.

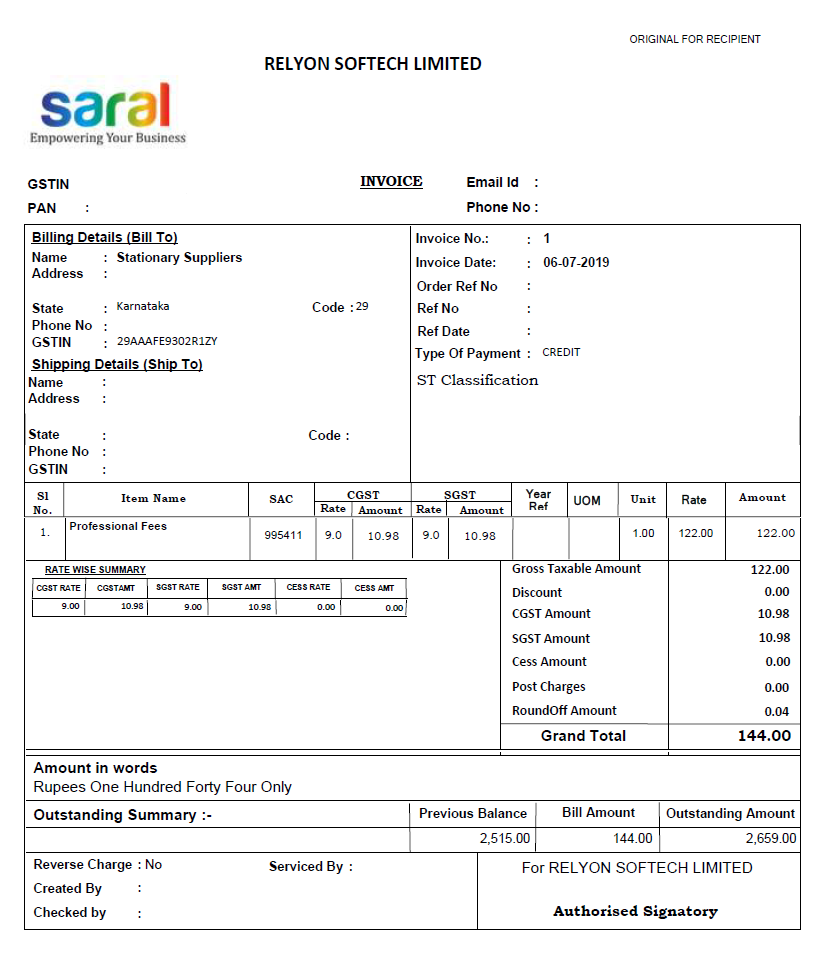

Sample template of GST service invoice

Sample template of GST service invoice

Now let’s see a sample of GST service invoice for better understanding:

Download the PDF format of Service Invoice here

You can also see how it works in Saral:

- Service Invoicing in Saral – Part I

- Service Invoicing in Saral – Part II

- Service Invoicing in Saral – Part III

- Service Invoicing in Saral – Part IV

This wraps up the post for now. We hope you had a clear view of the GST service invoice. We would love to hear your opinion and feedback in the comment section below.