Hello, in this post we will see what is a credit note and debit note under Goods and Services Tax (GST).

We discuss the following topics here:

- What are the Credit note and Debit note under GST?

- Mandatory details to be included

- What is a Credit note?

- When to use a Credit note?

- What is a Debit note?

- When to use Debit note?

- Revised invoices under GST

- Points to Remember

What are the Credit note and Debit note under GST?

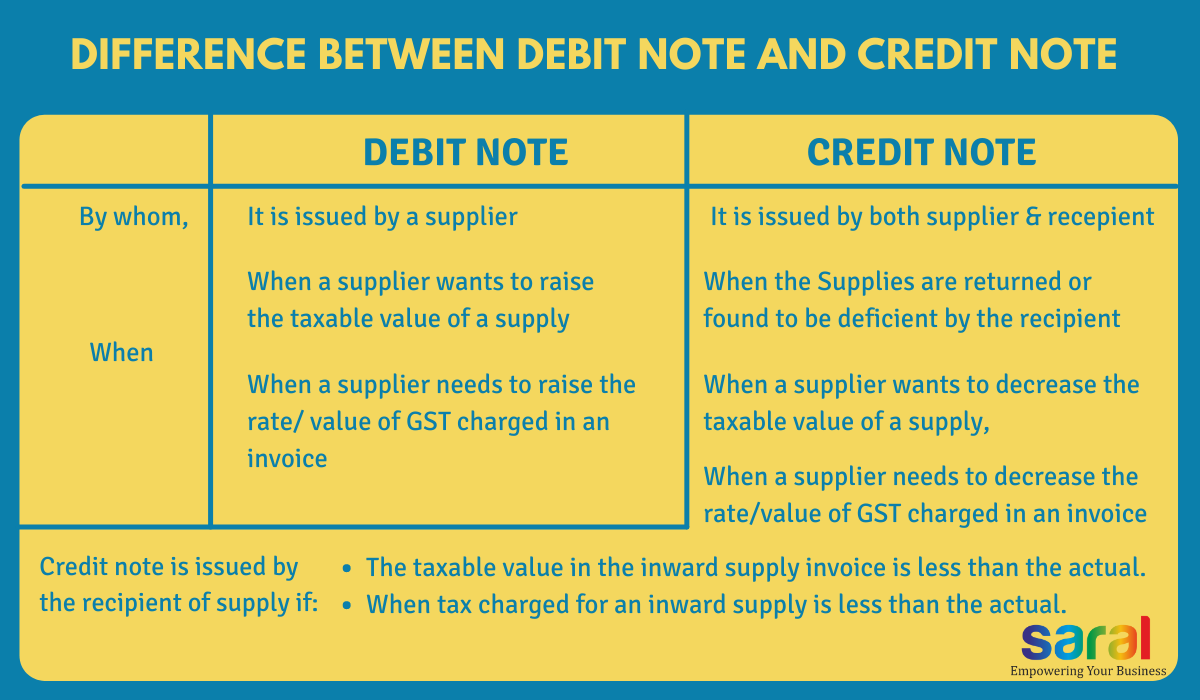

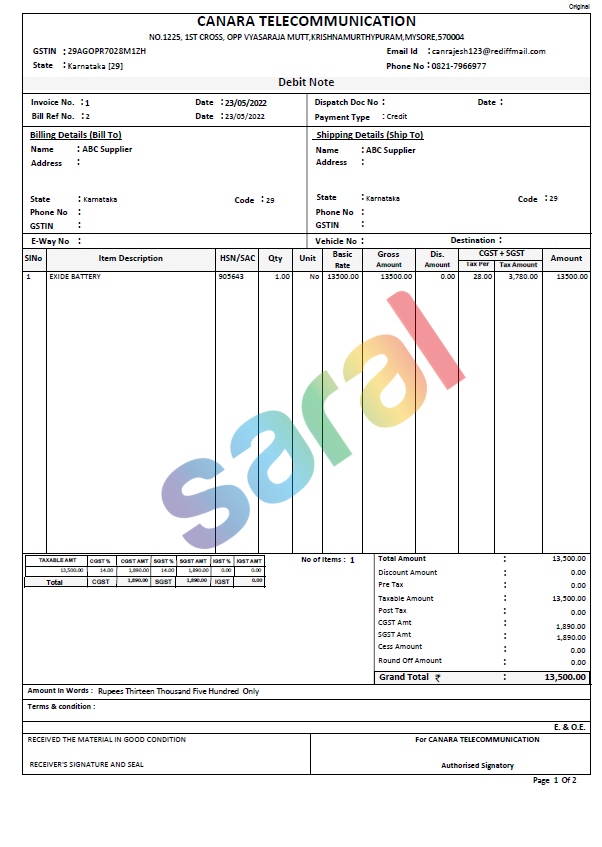

Debit Note under GST

The issued debit notes details should be provided in Form GSTR-1 for the month in which it was issued. These details are available to the recipient in Form GSTR-2A, post which the recipient needs to accept the details and submit in Form GSTR-2.

Note:

A recipient can also raise a debit note when:

- When received goods are returned.

- When goods are damaged in transit.

- The taxable value shown in the invoice is more than the actual.

- Tax charged is more than the actual.

However, under GST it is produced by a supplier only will be considered for revision in the values of an invoice. The recipient should accept it for the corresponding impact on ITC on the supply.

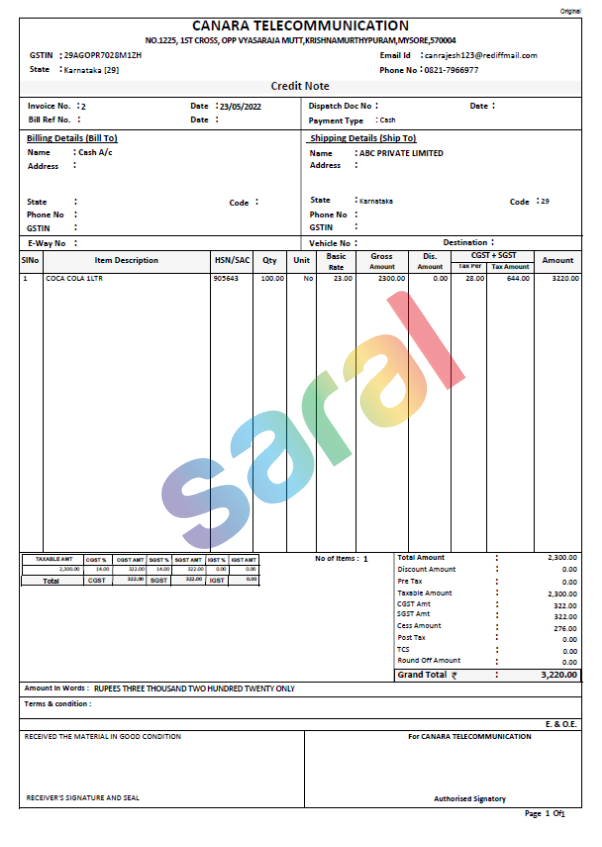

Credit Note under GST

The suppliers need to provide the details of credit notes issued in a month in Form GSTR-1. These details are available to the recipient in Form GSTR-2A, post which the recipient needs to accept the details and submit in Form GSTR-2. A supplier is allowed to reduce his tax liability by credit note only if the recipient of the supply accepts these details in Form GSTR-2.

Then the recipient’s ITC will be reversed to the extent of the credit note and the supplier’s tax liability will also be correspondingly reduced.

Note:

A credit note can also be issued by the recipient of supply if:

- The taxable value in the inward supply invoice is less than the actual.

- When tax charged for an inward supply is less than the actual.

When a supplier produces a debit note for the supply, the revision in the values of an invoice will only be considered.

The details of a debit note issued have to be furnished by the supplier and the same has to be accepted by the recipient. Therefore, the tax liability of the supplier and the recipient’s ITC will be modified.

Mandatory details to be included

The details that need to be present in debit and credit notes are:

- The clarity in the document’s nature (like ‘revised invoice’ or ‘supplementary invoice’).

- Name, address, and GSTIN of the supplier.

- A unique consecutive serial number with alphabets/ numerals or special characters hyphen “-“ or slash “/”, for a financial year.

- Date of issue of the document.

- Registered recipient– Name, address of the recipient and GSTIN/Unique ID number.

- Unregistered recipient– Name, address of recipient and address of delivery, with state and code.

- Serial number and date of the original tax invoice/bill of supply.

- The taxable value of the goods/services, rate of tax and the amount of tax credited/debited to the recipient.

- A signature/digital signature of the supplier or authorized representative.

What is a Credit note?

A registered person issues a credit note under Section 34(1) when supplies are returned /found deficient / decrease in taxable value or GST charged in the invoice. The credit note is issued based on an original invoice already issued. So, when the registered person issues the Credit note, it will reduce supplier’s tax liability.

When to use a Credit note?

The supplier who has supplied goods/services/both issues a credit note when:

- Supplies are returned/found to be deficient by the recipient – When goods/services supplied are returned/found to be deficient by the recipient, the supplier will issue a Credit note. It reduces the value of the original supply.

- A decrease in taxable value – When a supplier wants to decrease the taxable value of a supply, he/she issues a credit note to the recipient.

- A decrease in GST charged (in the invoice) – When a supplier needs to decrease the rate/value of GST charged in an invoice, he/she issues a credit note to the recipient.

What is a Debit note?

A supplier issues a debit note under Section 34(3) when there is a need of an increase in taxable value /an increase in GST charged in the invoice. There is no specified format for this, it can be issued as a letter or a formal document. when the supplier issues the Debit note, his tax liability will also increase.

A recipient can also issue a debit note when the goods are returned/ damaged in transit. But under GST, only the supplier can issue the debit note.

When to use Debit note?

The supplier will issue a debit note in GST for the following reasons:

- Increase in Taxable Value -When a supplier wants to raise the taxable value of a supply, he/she issues a debit note to the recipient.

- Increase in GST charged in invoice – When a supplier needs to raise the rate/ value of GST charged in an invoice, he/she issues a debit note to the recipient.

What is a Revised Invoice under GST?

What is a Revised Invoice under GST?

All the taxable dealers should apply for provisional registration and carry out all the formalities to get a permanent registration certificate.

For all the invoices issued between the period:

- Date of GST implementation.

- Date of issue of the Registration certificate.

The dealers issue a revised invoice against already issued invoices in that specific period. This invoice is issued within 1 month from the registration certificate date of issue.

Points to Remember

- The amount entered in a credit note is always negative and in a debit note, it is positive.

- Maintain the debit or credit note for 6 years from the due date of furnishing the yearly tax return.

- The debit and credit note must be as per GST law.

- Remember to issue the credit note earlier to the date of filing yearly returns or 30th Sept of every FY. It is because the credit note reduces the tax liability.

- There is no due date to issue a debit note.

We have come to the end of this post. Please share your views or questions with us in the comment section below.