In this post, we will learn the process for E-way bill generation through E-way bill portal.

We will cover the following topics:

- What is an E-way bill?

- Pre-requisites of the E-way bill

- E-way bill format

- New features

- Generation process for E-way bill

- E-way bill reprint

- Part-B of E-way bill generation

What is an E-way bill?

E-way bill is an electronic way bill for the movement of goods. It helps to track the movement of goods as per GST norms and helps to avoid the tax evasion.

It is generated from the E-way bill portal by a registered taxpayer under GST who needs to transport goods worth more than Rs 50,000.

If the inward supply of goods is done by an unregistered person, then he should also generate the E waybill.

E-way bill can be generated or cancelled through SMS, Android App and by site-to-site integration through API.

After the generation of the E-way bill, a unique E-way Bill Number (EBN) is available to the supplier, recipient, and the transporter.

Pre-requisites of the E-way bill

The pre-requisites for generating E-way bill are as below:

- Registration on the E-Way Bill portal

- Invoice/ Bill of Supply/ Challan in relation to the transportation of the goods.

- By road – Transporter ID or Vehicle number.

- By rail, air, or ship – Transporter ID, Transport document number, and date on the document.

E-way bill Format

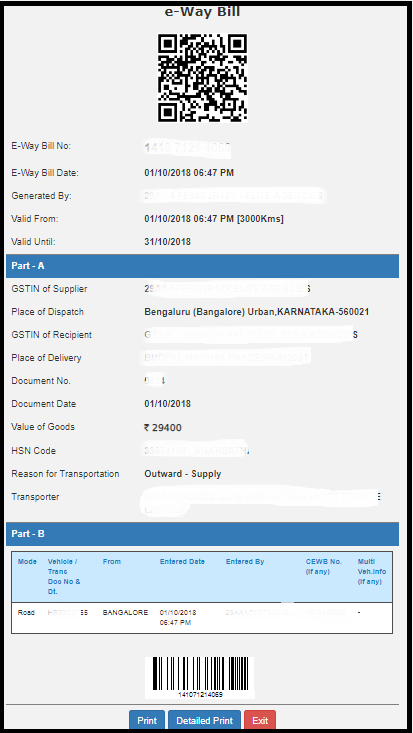

Form GST EWB-01 is the E-Way Bill and it has 2 parts Part A and Part B. Part A has the details of the goods, and Part B contains vehicle number.

| PART A | PART B |

|---|---|

| GSTIN of Recipient (if the recipient is unregistered mention as URP) | Vehicle Number in which goods are transported |

| Place of Delivery – PIN Code of Place | |

| Invoice or Challan Number | |

| Invoice or Challan Date | |

| Value of Goods | |

| HSN Code – At least 2 digit of HSN Code | |

| Reason for Transportation – Supply / Exp / Imp / Job Work, etc. | |

| Transportation Document Number (TDN) – Document Number provided by the transporter |

Newly added :

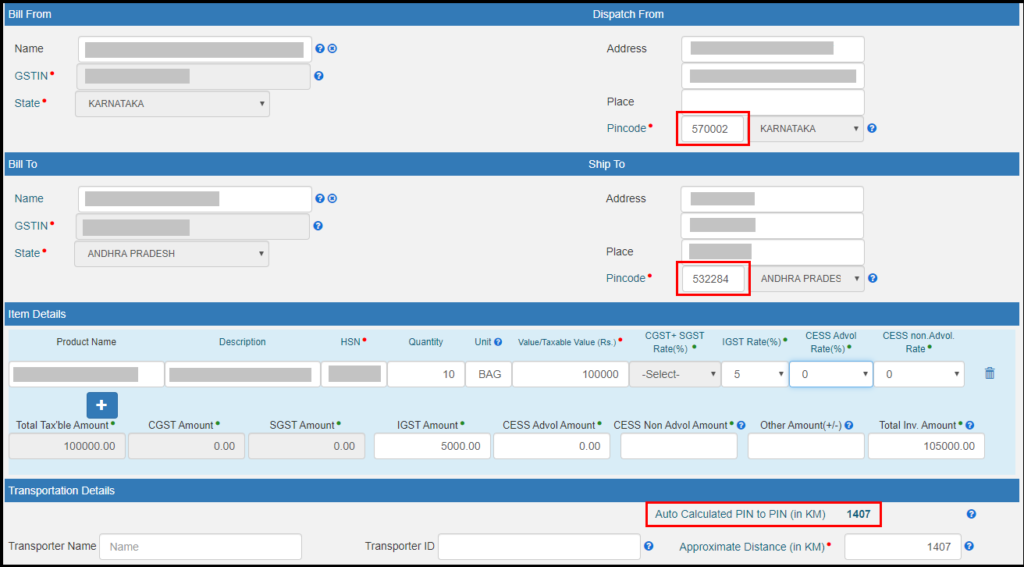

E-Way bill portal has now added a new feature: auto-calculation of the distance between the source and destination, based on their respective PIN codes.

Generation process for E-way bill

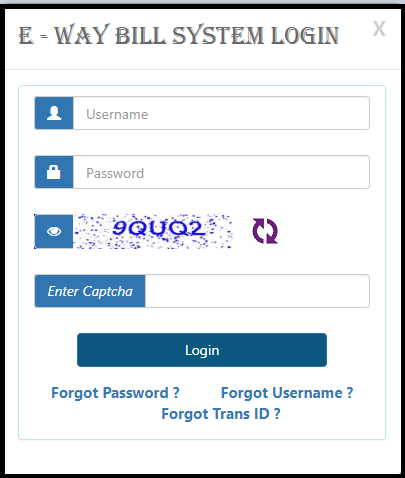

Step-1: Visit Eway bill common portal website at ewaybillgst.gov.in/login and log in.

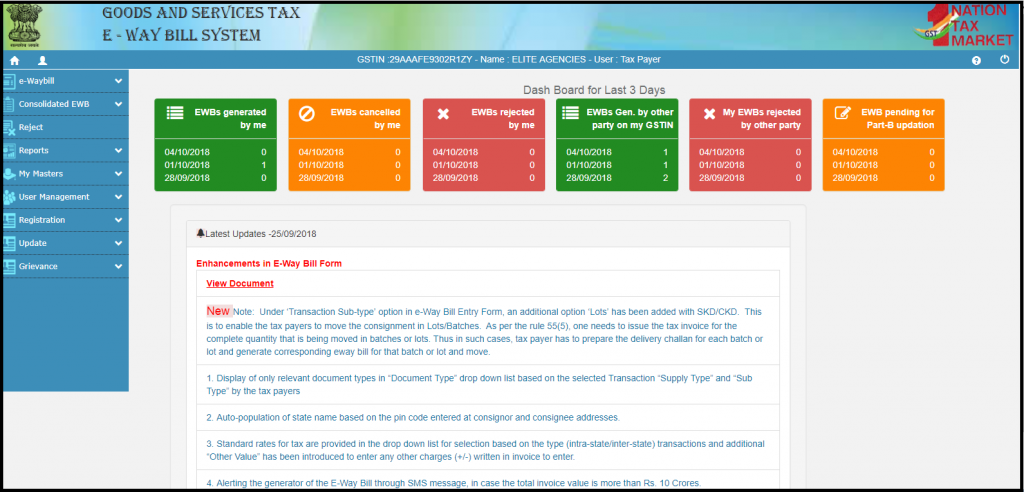

Step-2: You will be then re-directed to the dashboard of your E-way bill portal login. Information regarding your recent process in the portal and other options will be available on this screen.

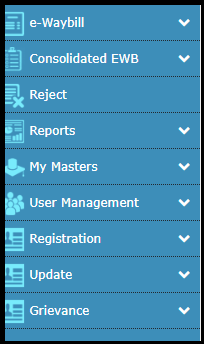

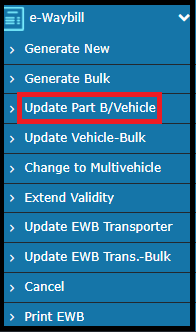

Step-3: Different options required for Eway bill generation are listed as below.

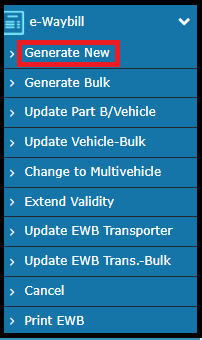

Step-4: To generate a new Eway bill, go to e-Waybill -> “Generate New“.

Step-5: The details entry screen will be displayed. Enter the required details;

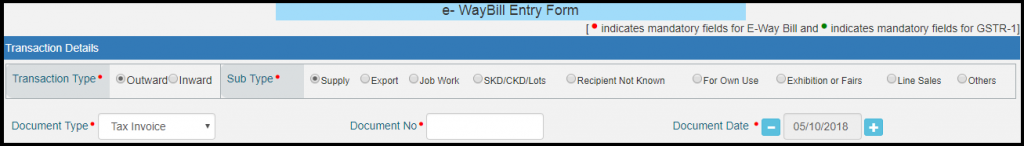

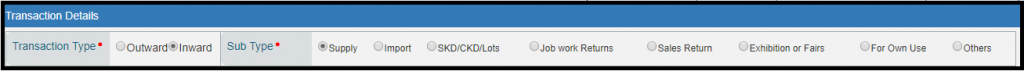

Transaction details:

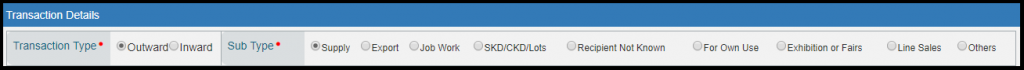

Transaction Type: Outward if you are the supplier and Inward if you are the recipient of the goods.

Sub Type: Depending on the transaction type, the sub-type of the transaction will be displayed.

For Outward:

For Inward:

Document Details: The information of the document being sent with the goods i.e., Document type, document no and document date.

![]()

Note: You will not be allowed to enter the future date.

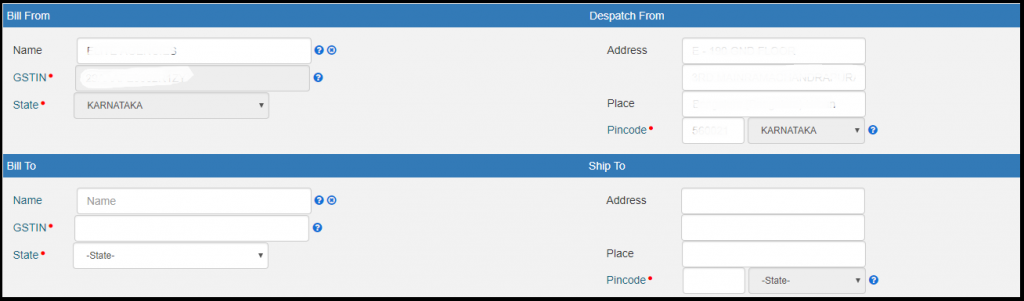

Bill From & Bill To details: The details of the supplier and the recipient of the goods. Depending on the type of transaction, your details will be auto-filled in From / To section.

Enter the other details.

Note: If the supplier/recipient is unregistered, then mention ‘URP’ in the field of GSTIN, which indicates that the supplier/recipient is an “Unregistered Person”.

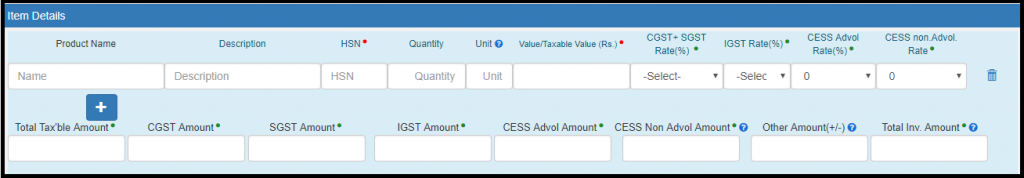

Item Details: Complete Details of the items that are being transported.

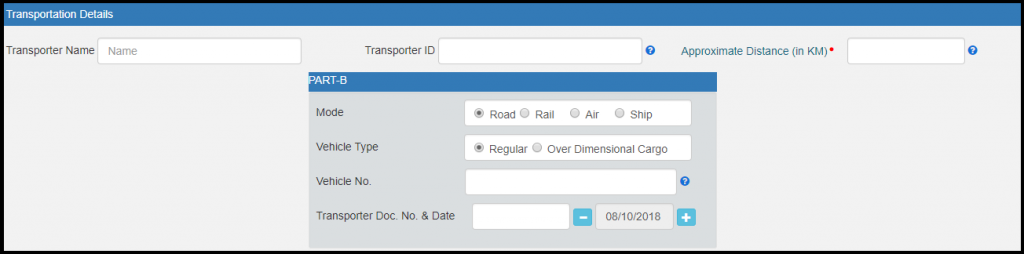

Transporter Details: The details of the transporter, transportation mode and the transporting vehicle details are given in this section.

Step-6: On entering all the details, click on Preview to re-look into the details. If you get a successful preview, click on Submit to generate the Eway Bill Number (EBN)

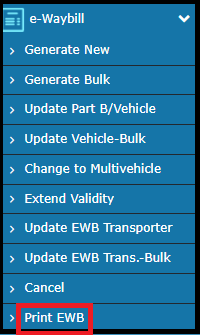

E-way bill reprint

If you want to re-print the Eway bill, then follow the below steps;

Step-1: Go to the e-way bill option on the left of the screen. Under this option, select “Print EWB”.

Step-2: Enter the EWB No. which is required.

The EWB will be displayed, which can be re-printed and used.

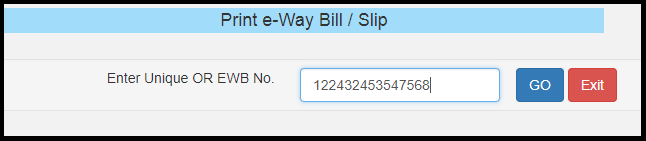

Part-B E-way bill generation

If you want to update the PART-B information in the EWB, then follow the below steps;

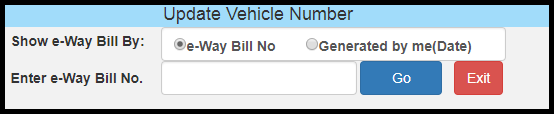

Step-1: Go to the e-waybill option on the left of the screen. Under this option, select “Update Part B / Vehicle“.

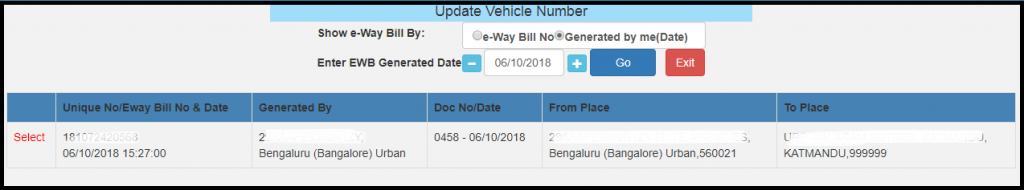

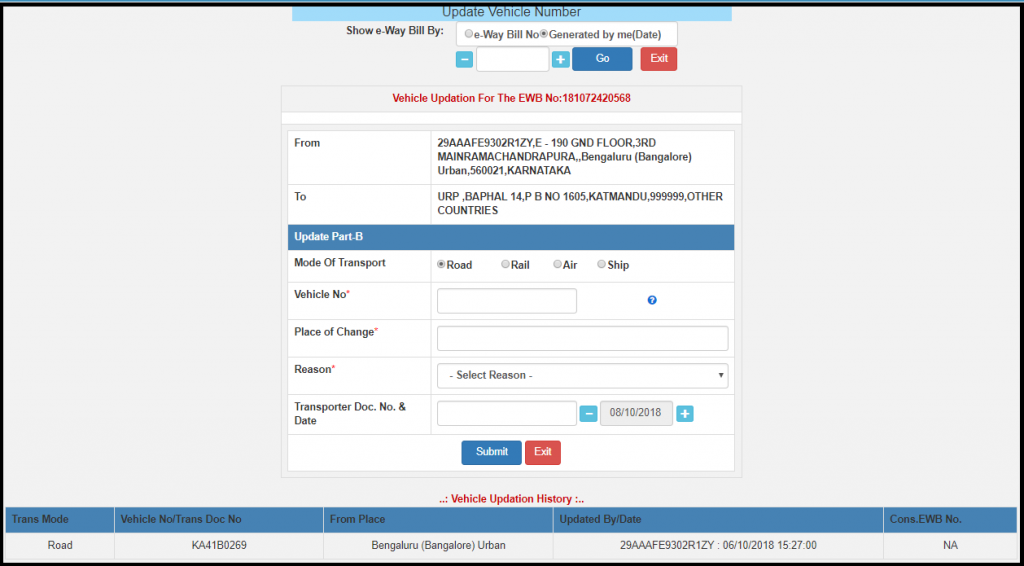

Step-2: Enter the EWB No. or the date of EWB generation. The EWB generated will be listed.

Step-3: Next, Select the relevant EWB, make the required changes and then click on Submit.

Then the changes will be updated.

With that, we come to an end of this post on e-way bill generation from e-way bill portal.